- Media /

- Investments Newsletter /

- 2Q2020 LMC Insights

Investments Newsletter

2Q2020 LMC Insights

U.S. multifamily sector remains resilient despite bleak economic backdrop.

State of the Economy

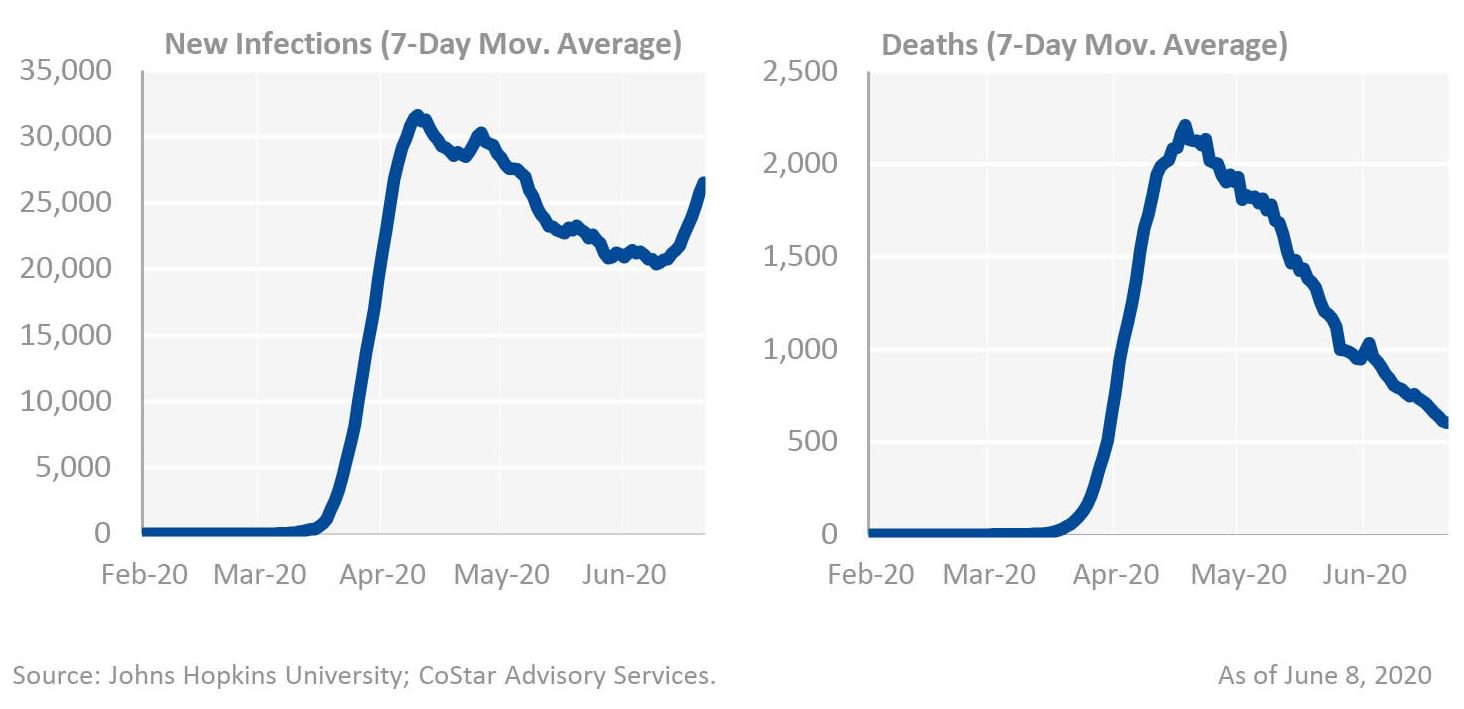

The sudden and unprecedented crisis spurred by the global spread of the novel Coronavirus has had far-reaching impacts across the U.S. economy. Mass lockdowns created waves of temporary and permanent layoffs, global supply chains were disrupted, and growth prospects were swiftly tempered. Despite these dire effects, the current situation is only a piece of the whole picture and much of the story has yet to unfold.

Current conditions could bode well for an easier road to recovery. The Federal Reserve took immediate action in the wake of the lockdowns, reactivating programs from the last recession and implementing new ones to increase lines of credit to American businesses. Easing restrictions in recent weeks have lifted economic data such as change in hours worked, change in retail visits, and continuing unemployment claims, while driving mobility returned to normal levels in late May.

Much of the ability for the economy to rebound rests on avoidance of a potential second wave of infections, and there is a real risk that restrictions may be placed back on which businesses can re-open fully as infection rates are now on the rise in 21 states. Similarly, economic stimulus from the CARES Act has propped up the American consumer over the last few months, but with most of the programs in the act set to expire at the end of July, consumer sentiment and demand may tumble further if stimulus is not extended.

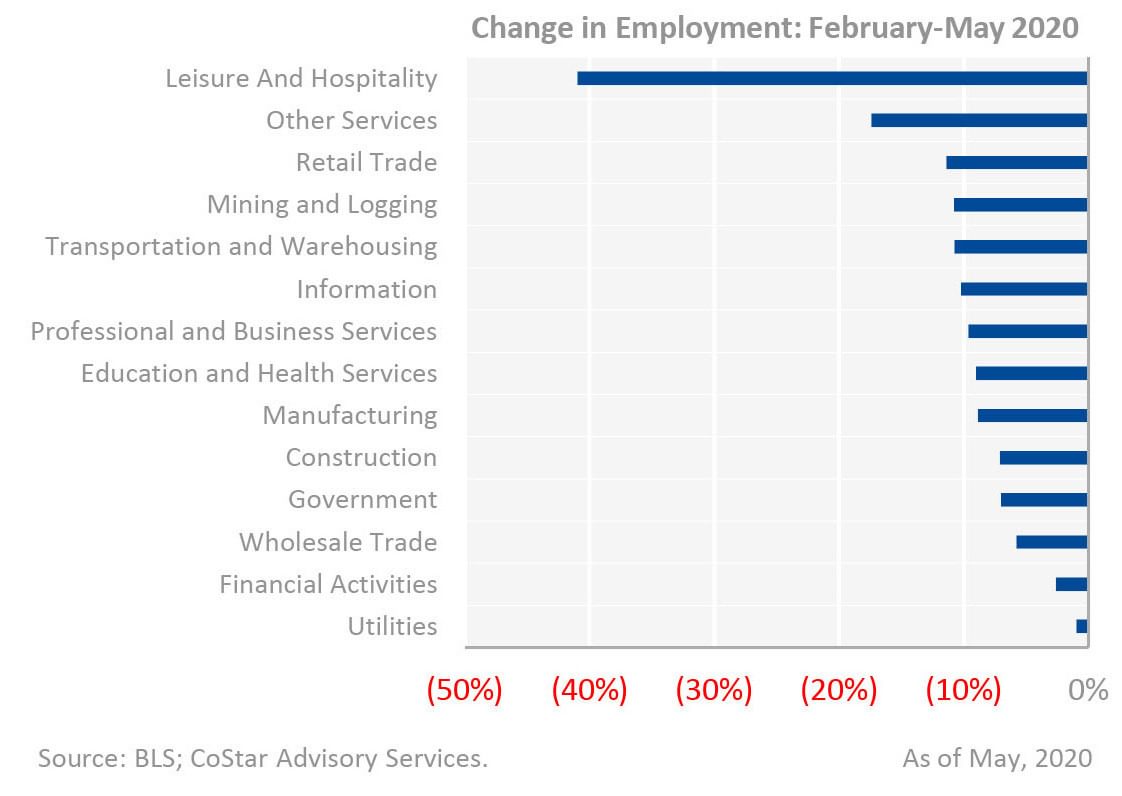

For now, the economy remains mostly structurally intact. This is both due to the roughly $3 trillion in stimulus the Fed has injected into the economy and the effects of the lockdown falling heaviest on blue collar jobs like leisure and hospitality, retail, and manufacturing. To illustrate the imbalance in the layoffs, as these workers were placed on temporary leave or cut outright, average wages actually rose by 7% year-over-year in April as most business professionals simply moved online.

The good news is that economic activity appears to be returning as states figure out how to implement phased reopenings. High frequency data shows net positives for change in hours worked, change in retail visits, and continuing jobless claims, while driving mobility has returned to levels experienced in early March.

Multifamily Investment Outlook

The multifamily market remains remarkably steady in the face of the pandemic, buoyed by stimulus allowing many tenants to stay current on rent payments. Occupancy rates nationally are down 0.6% year-over-year, to 93.3%, the lowest since 2011. Given the number of job losses, it is possible that occupancies may continue to decline in 2020 before workers are able return to the labor force. While close to 610,000 units, or 3.6% of total inventory, is under way, only 300,000 units may actually deliver this year, given that construction delays and shutdowns postponed many projects by three months or more.

The magnitude of construction stoppages was mixed across the U.S. as each municipality implemented their own interpretations of social distancing and essential activities. For new projects, investors have put future land purchases on hold or delayed closings to the extent possible. There is expectation that construction costs will decline in the medium term, although the benefit of a sudden excess in labor supply and hard cost declines have yet to be realized.

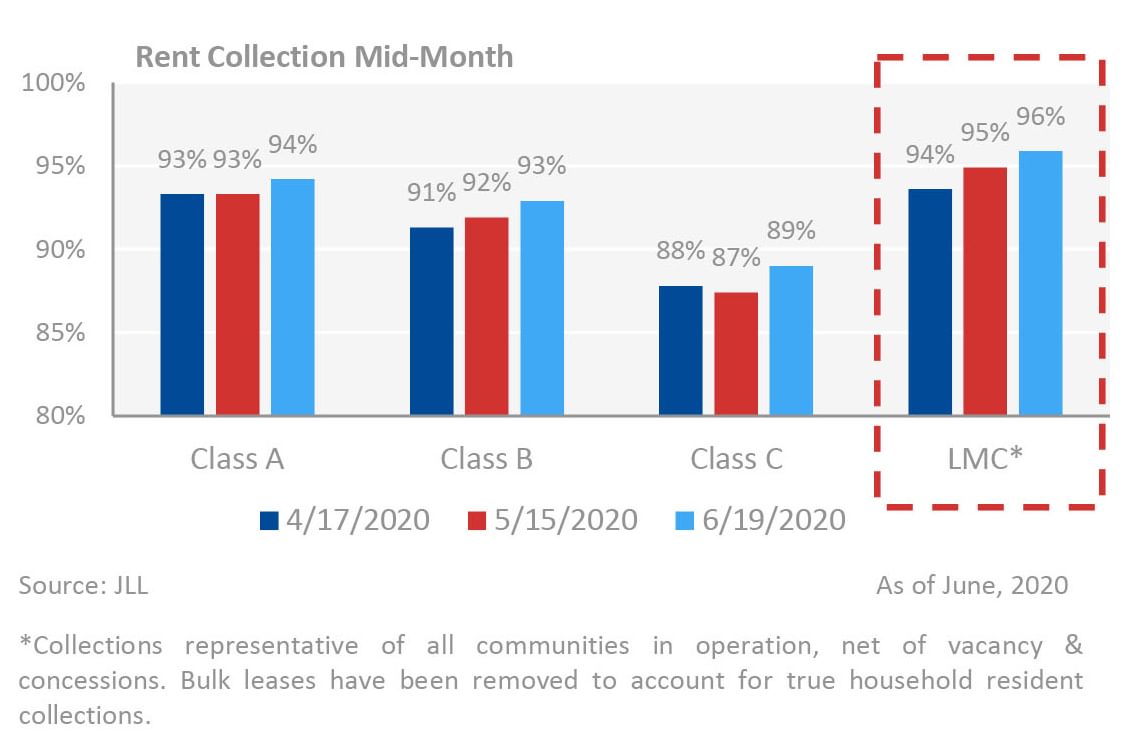

Examining the numbers in depth reveals nuance in the multifamily story. As the downturn has yet to fully impact white collar workers, the main residents of 4 & 5 Star, the tenants of Class A assets have been largely paying their rents as occupancies and collections have held up in this sub-sector the strongest. As of June 19, 2020, JLL estimates that across 874,000 units in the U.S., rent collected in Class A apartments have averaged 94%, while B and C properties trail at 93% and 89% respectively. This further illustrates the class A “renter by choice” narrative that has been less impacted by job displacements.

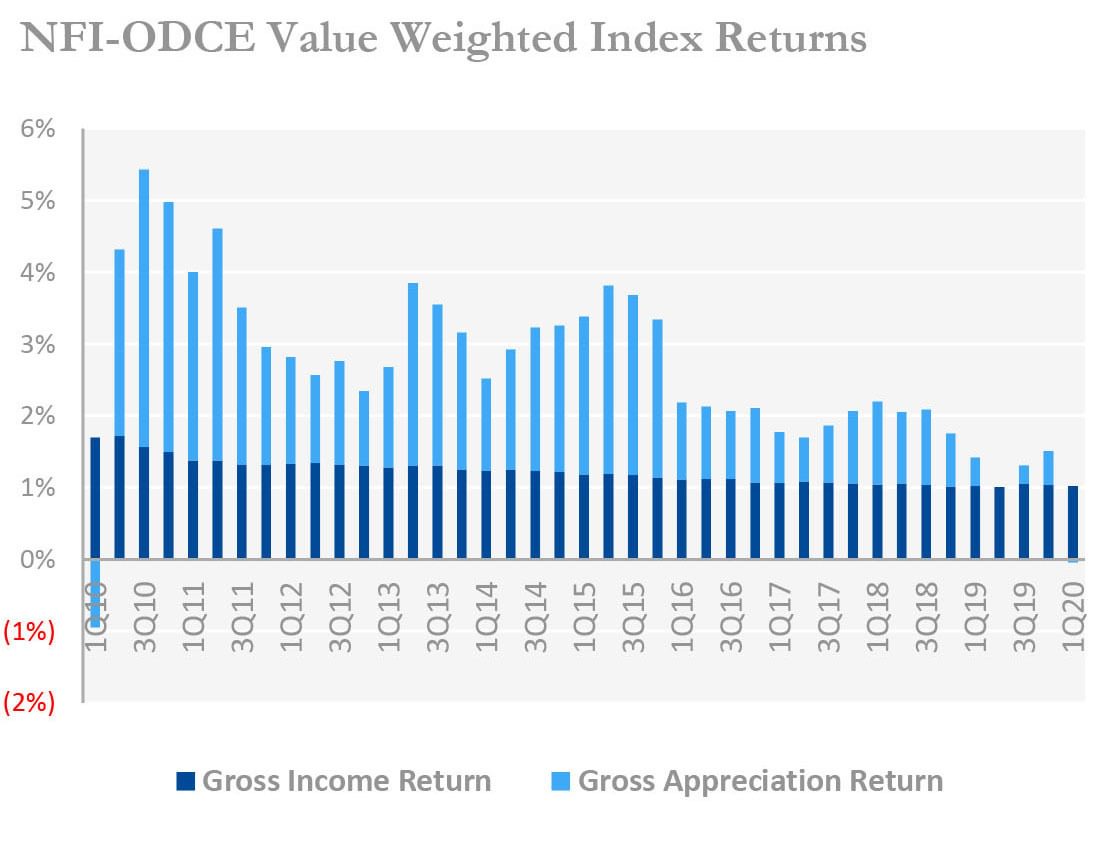

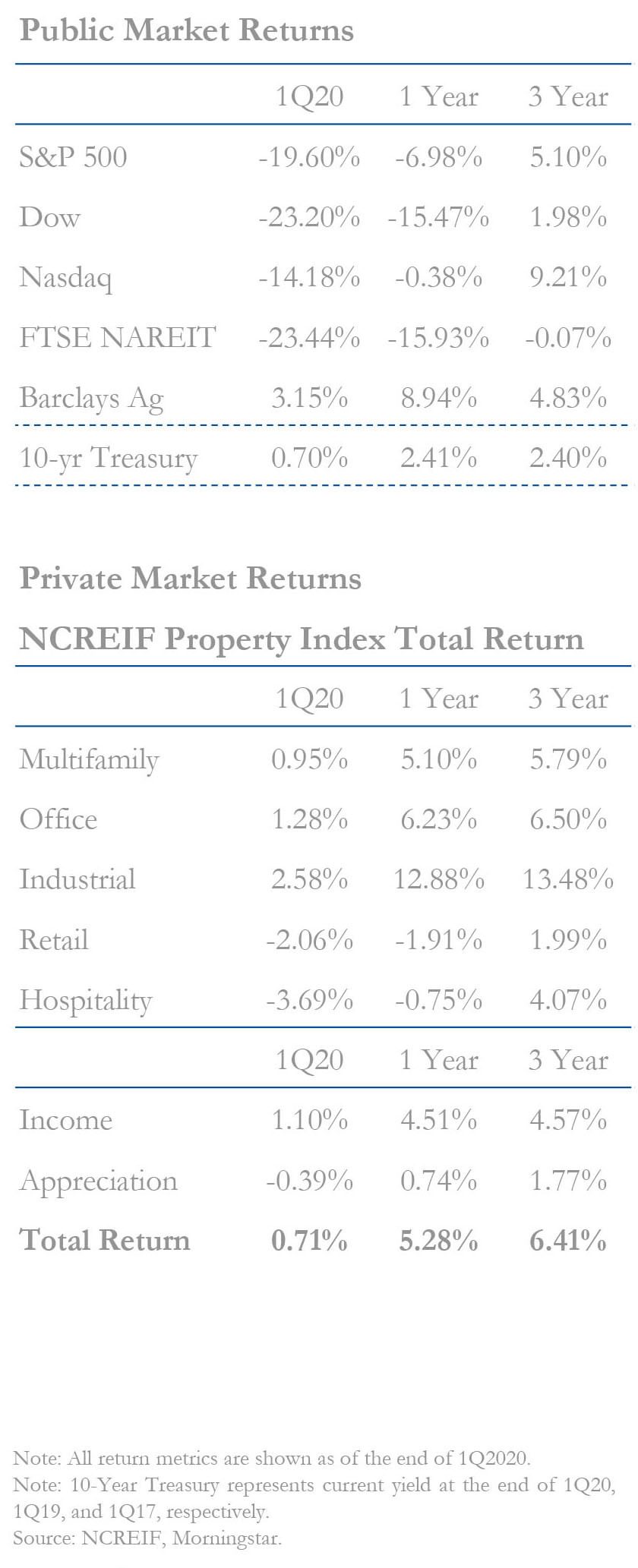

NCREIF can provide insight into the returns private capital is receiving from institutionally owned private real estate in the US, and particularly for high quality assets in core markets with their Open End Diversified Core Equity (ODCE) index.

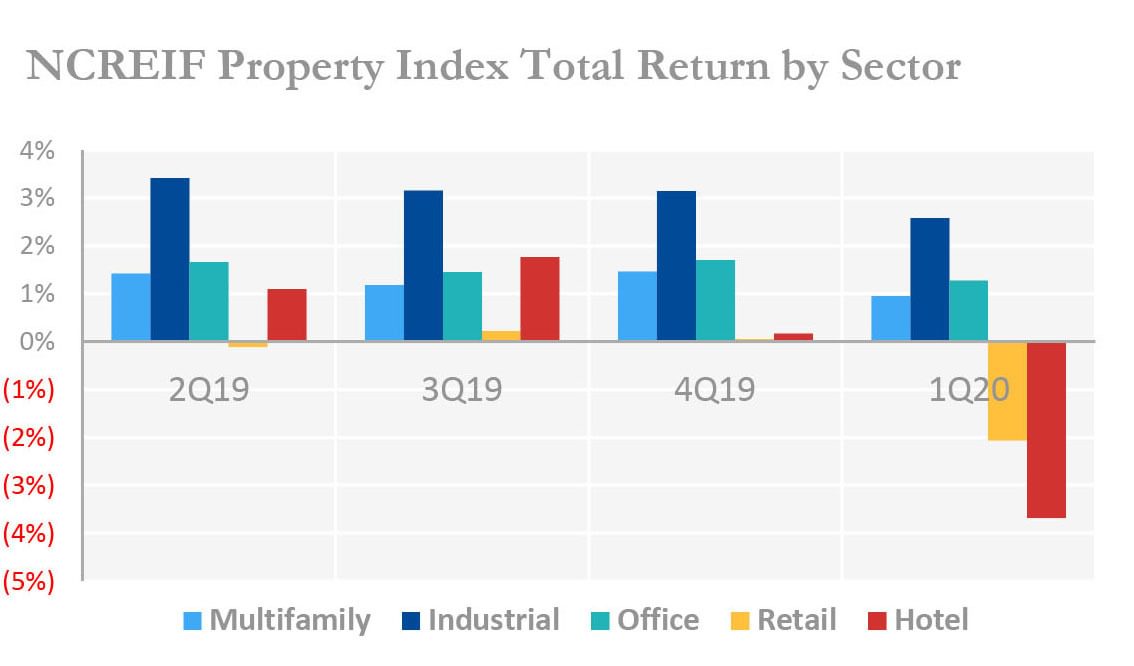

NFI-ODCE, which as of 1Q20 includes approximately a 27% weighting to multifamily, saw it’s second quarter of negative appreciation since 1Q10, at (.04%). Despite this, income returns for the Core space continue to hold up well (1.02%), dampening the effects of negative appreciation. When turning to NCREIF’s unlevered property level index (NPI), multifamily finished the quarter as the third best performing sector, behind industrial and office, and ahead of retail and hotel properties.

Transaction volume has fallen across all property types and multifamily is no exception. For-sale listings are half of normal levels as buyers and sellers alike wait for the pandemic to subside. National sales volume in the first quarter was $30.2 billion, down from the last three quarters of 2019 when volume topped at least $40.0 billion, but comparable to 1Q19 when $31.9 billion traded. The current lack of trades will impact how sellers mark to market, but multifamily is best suited to retain value given stable rent rolls and consistent demand, factors discussed next in this quarter’s special segment.

In Focus: Playing Defense With Multifamily

While the Coronavirus represents a significant downside risk across property types and asset classes, including multifamily, apartments have been shown to be resilient in past recessions. Multifamily housing remains a necessity and fulfills a basic human need for households during a recession. Though downturns will put negative pressure on rents, occupancies have remained stable for the sector. Importantly, multifamily has outperformed on returns as well. NCRIEF total multifamily returns since 1978 have averaged 2.5%, outpacing industrial (2.4%) and office (2.0%). This is coupled with the fact that the volatility of those returns is also the lowest for multifamily, yielding the best risk-adjusted returns across the four main property types.

U.S. Housing Shortage Buoys Demand for Rental Housing

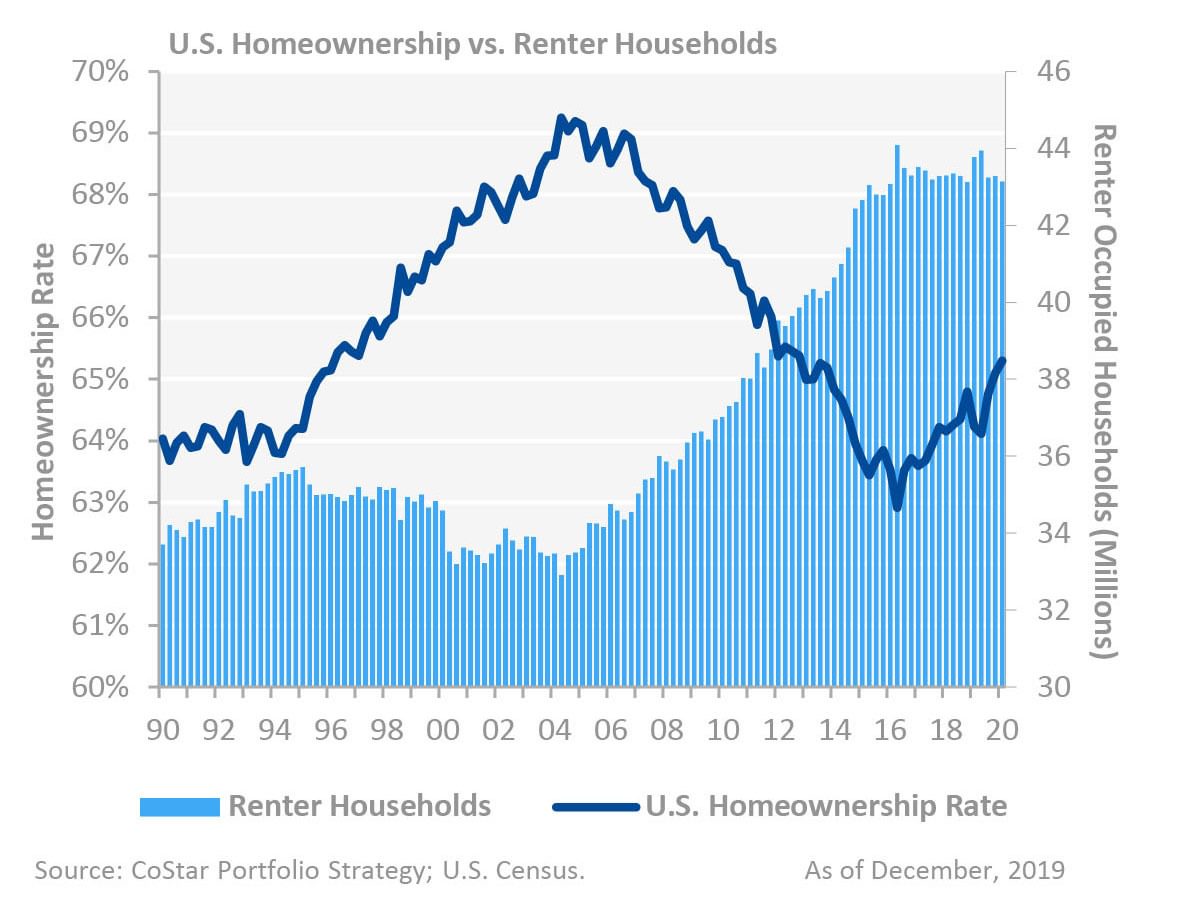

Multifamily also has an advantage that it did not in the previous recession. The economy enters the current downturn with a severe shortage of owner-occupied housing. The perennial lack of housing supply has been a potent driver of millennials into the rental market, as supply of entry level homes has all but dried up, particularly in coastal markets.

Declines in Homeownership Have Spiked U.S. Renter Demand

Short Term Leases Keep Occupancy High and Provide for Quick Rebound

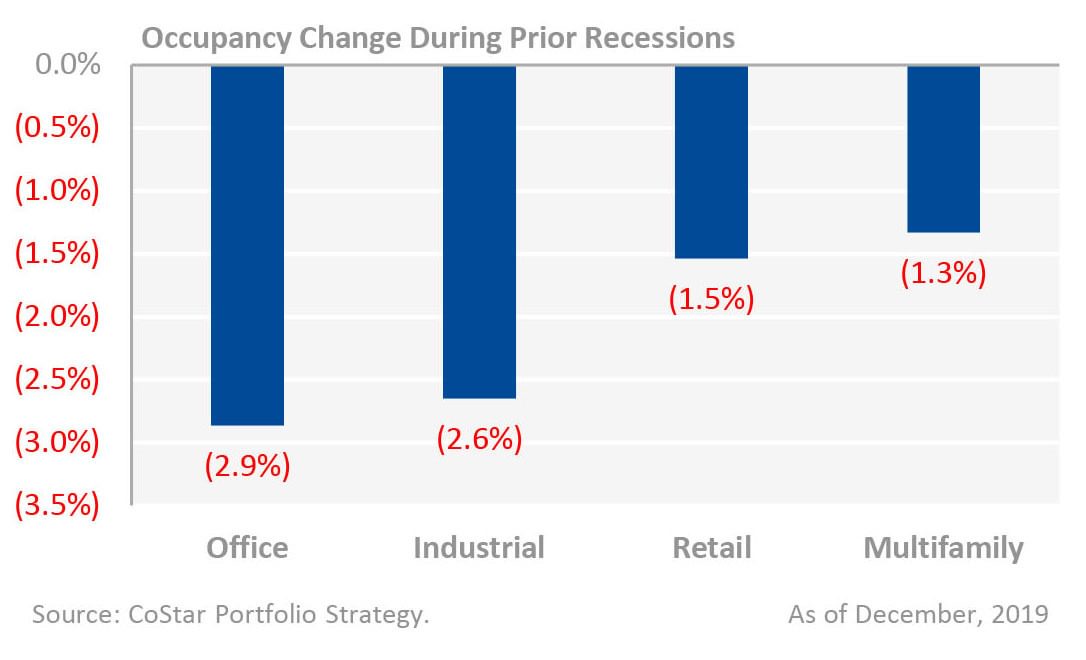

Of similar importance for multifamily operators is the ability to transition leases appropriately in recessionary periods. While leases expiring or tenants vacating due to bankruptcy might create long-term vacancies for other property types, the shorter lease length for apartments is an opportunity to mark-to-market appropriately, thus mitigating NOI losses. This, combined with a consistent pool of renter demand, is why multifamily occupancies hold up best among the four major property types. On average, multifamily vacancies rose by a little more than 2.4% during the last two recessions. Compare that to industrial, another outperformer over the last cycle, which increased 3% on average. Short leases also spur rents to recover swiftly. In major metros, multifamily rents returned to pre-recession highs 60% faster than industrial, and roughly 250% faster than office.

During Recessions, Multifamily Occupancies Hold Up Best...

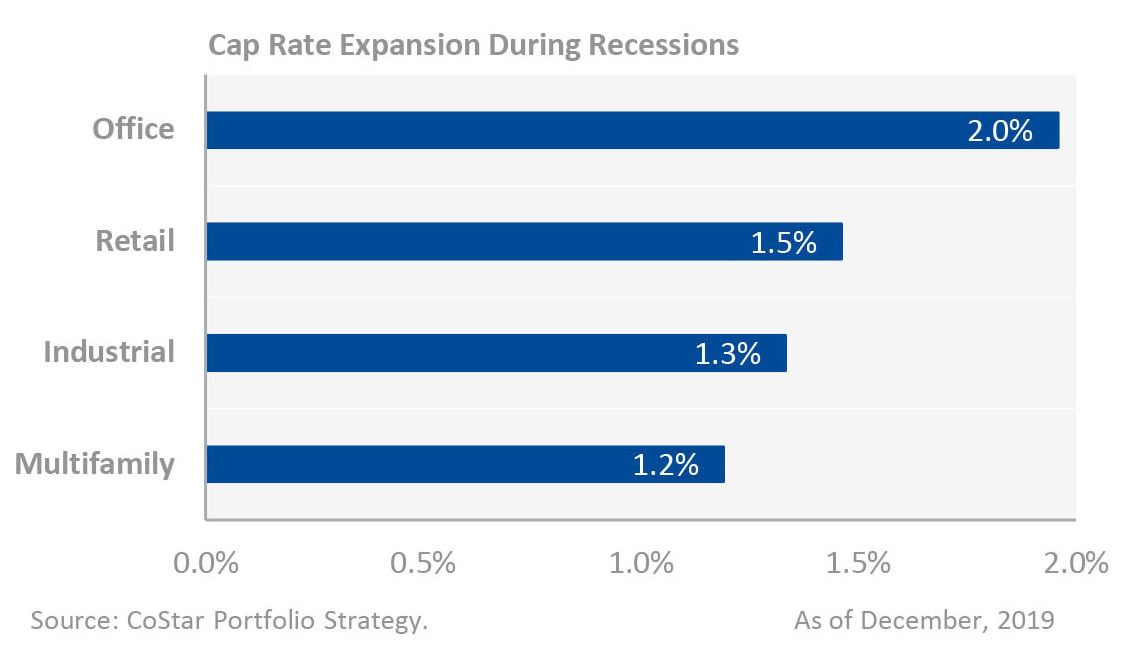

Multifamily Risk Profile Prevents Extensive Cap Rate Widening

Lastly, multifamily values hold up better through a recession when gauged by cap rates. During the last recession, office and retail cap rates rose on average between 1.5% and 2.0%, while multifamily cap rates expanded only 1.2%, the lowest of the property types. This muted volatility in pricing may explain why investor appetite for multifamily acquisitions increases even late in an economic cycle.

…While Multifamily Cap Rates Unwind the Least

As we enter the current downturn, investors looking for shelter might be well served to consider core multifamily assets given the enduring and robust demand story, an overall lack of housing supply nationwide, and the consistent ability for multifamily to hold up best in key performance indicators like pricing and occupancy.

DOWNLOAD FULL INSIGHT PDF HERE

About LMC

Lennar Multifamily Communities, LLC (“LMC”) is a vertically integrated multifamily real estate investment company focused on developing, acquiring and operating Class A apartments in the United States. A wholly owned subsidiary of Lennar Corporation (“Lennar”), LMC combines the financial strength and entrepreneurial spirit of Lennar, the nation’s largest homebuilder and acquirer of land, with the increasingly favorable apartment demand fundamentals nationwide. LMC currently employs over 600 professionals across 14 offices nationwide. With approximately $8.8 billion of gross assets under management, we offer multifamily investment strategies to a diverse set of institutional investors including pension funds, sovereign wealth funds, insurance companies, private equity companies, large commercial banks, and high net worth individuals.

Disclaimers

All information contained in this publication is derived from sources that are deemed to be reliable. However, LMC has not verified any such information, and the same constitutes the statements and representations only of the source thereof, and not of LMC. Any recipient of this publication should independently verify such information and all other information that may be material to any decision that recipient may make in response to this publication, and should consult with recipient’sown professionals with regard to all aspects of that decision, including its legal, financial and tax aspects and implications. Any recipient of this publication may not,without the prior written approval of LMC, distribute, disseminate, publish,transmit, copy, broadcast, upload,download, or in any other way reproduce this publication or any of the information it contains.

These Costar Portfolio Strategy and CoStar Risk Analytics materials contain financial and other information from a variety of public and proprietary sources. CoStar Group, Inc. and its affiliates (collectively, “CoStar”) have assumed and relied upon,without independent verification, the accuracy and completeness of such third party information in preparing these materials.

The modeling, calculations, forecasts, projections, evaluations, analyses, simulations, or other forward-looking information prepared by CoStar and presented herein (the “Materials”) are based on various assumptions concerning future events and circumstances, which are speculative, uncertain and subject to change without notice. You should not rely upon the Materials as predictions of future results or events, as actual results and events may differ materially. All Materials speak only as of the date referenced with respect to such data and may have materially changed since such date. CoStar has no obligation to update any of the Materials included in this document. You should not construe any of the data provided herein as investment, tax, accounting or legal advice.

CoStar does not represent, warrant or guaranty the accuracy or completeness of the information provided herein and shall not be held responsible for any errors in such information. Any user of the information provided herein accepts the information “AS IS” without any warranties whatsoever. To the maximum extent permitted by law, CoStar disclaims any and all liability in the event any information provided herein proves to be inaccurate, incomplete or unreliable. Follow this link for the technical definitions of CoStar building ratings (CoStar Buildings Rating System).

©2020 CoStar Realty Information,Inc. No reproduction or distribution without permission.